child tax credit 2021 eligibility

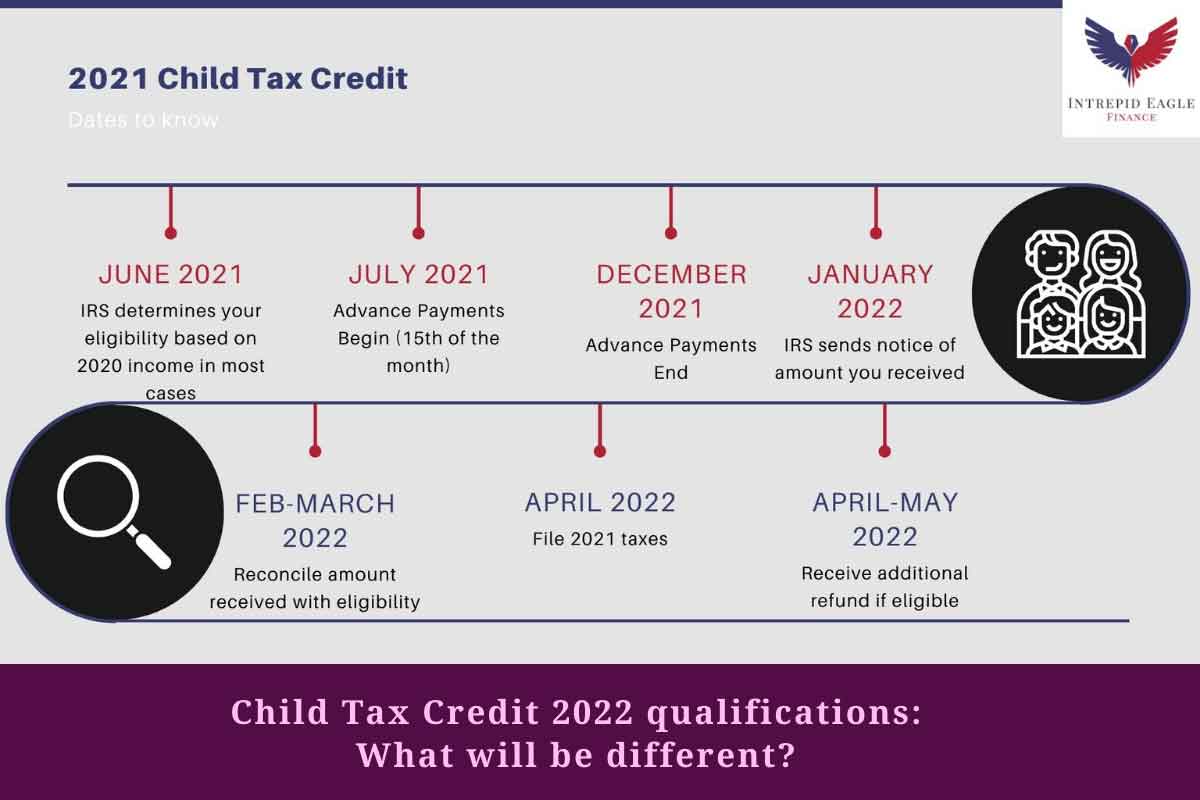

Parents must have an earned income of at least 2500. Finally if the qualifying children you listed in a Non-Filer Tool in 2020 or 2021 are the same qualifying children you had in 2021 you probably only received.

What Families Need To Know About The Ctc In 2022 Clasp

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line.

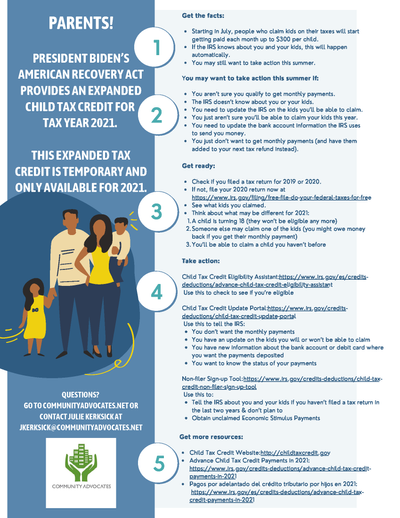

. For Tax Years 2018-2020 the maximum refundable portion of the credit is 1400 equal to 15 of earned income above 2500. Connecticut Child Tax Credit 2022-IRS Work at Home jobMost recent Update on the Child Tax Credit 2022. If you are eligible for the Child Tax Credit but did not get any advance payments in 2021 you can still get a lump-sum payment by claiming the Child Tax Credit benefit when you file.

Half will come as six monthly payments and half as a 2021 tax credit. The payment for children. Parents income matters too.

1 day agoThe application period for the 2022 Connecticut Child Tax Rebate opened on Wednesday. Already claiming Child Tax Credit. If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying child for purposes of the 2021 Child Tax Credit.

The expanded CTC is for your 2021 tax return which you file in 2022. The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021. Previously only children 16 and younger qualified.

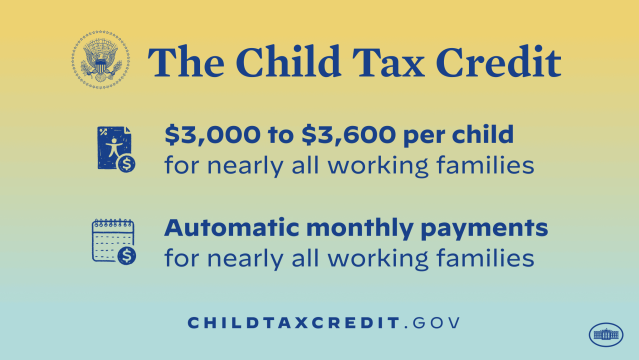

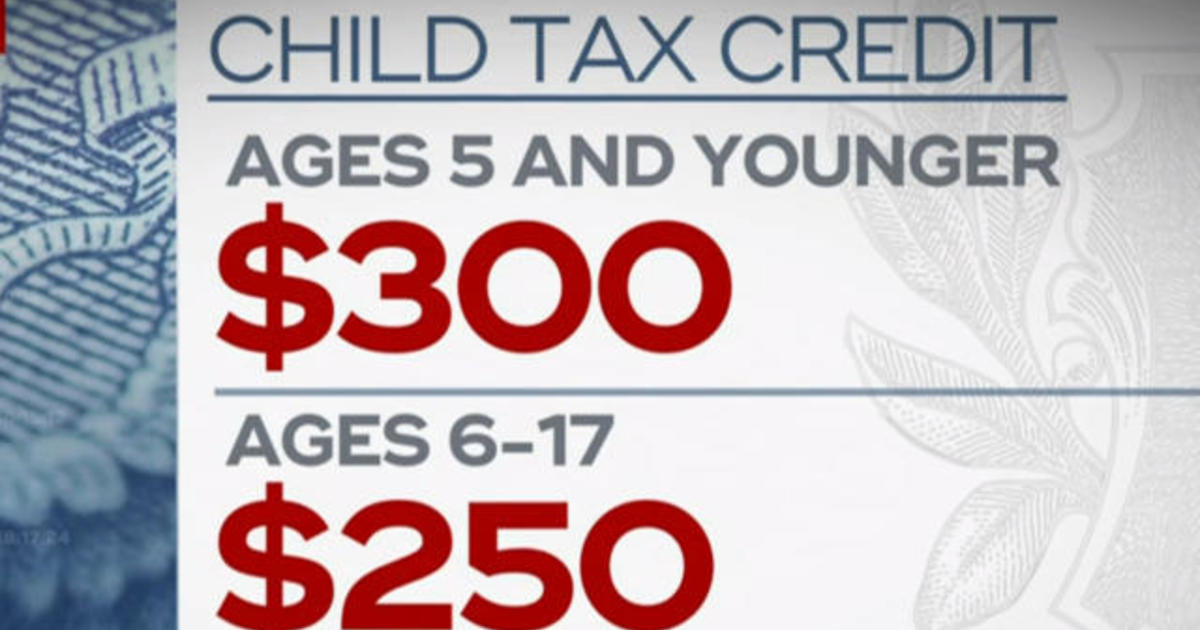

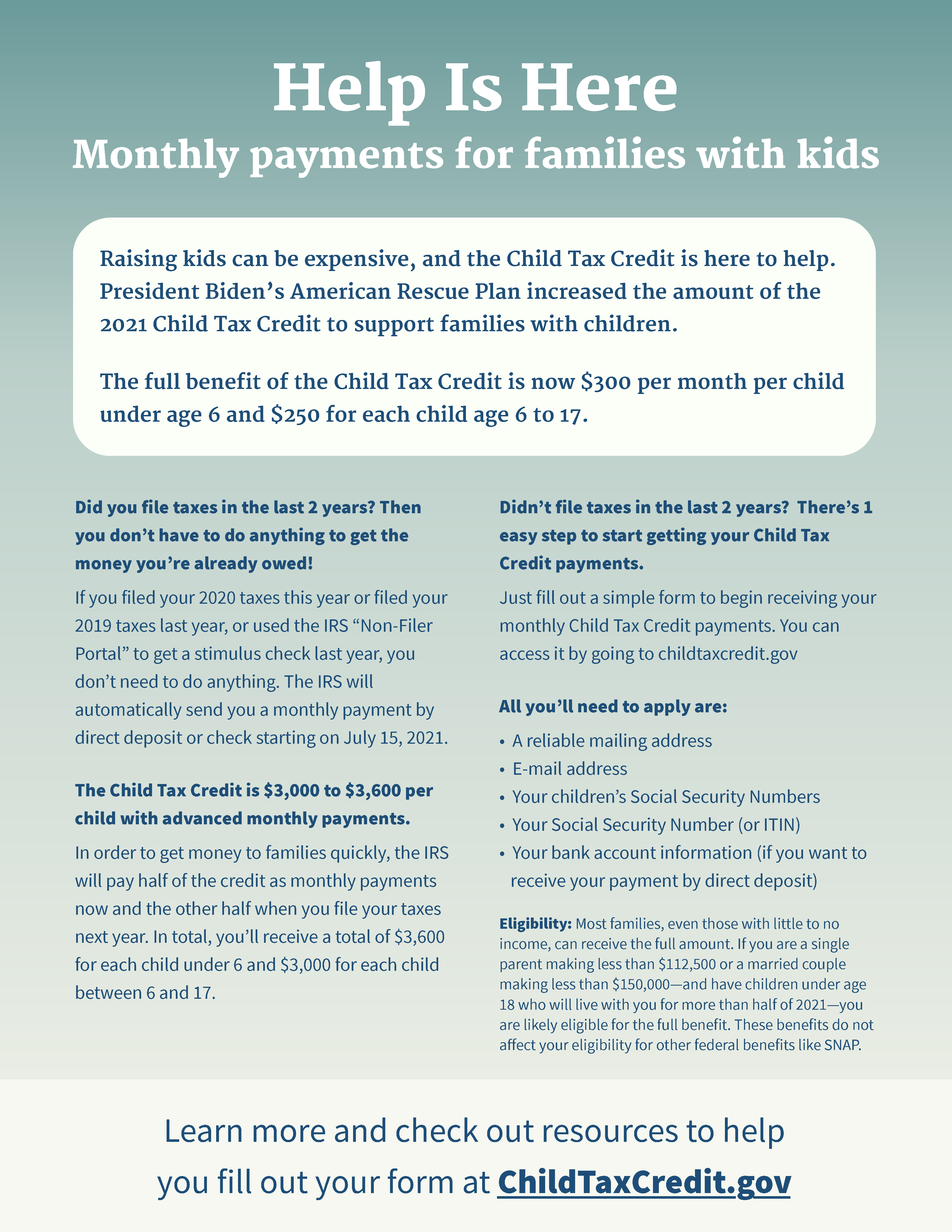

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

The rebate created as part of the budget bill that the governor signed into law in May provides taxpayers. A childs age determines the amount. State Child Tax Credit 2022.

In addition children must live with the taxpayer claiming the credit for more than half of the 2021 tax year. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Non-child dependents are now worth 500 in tax credits.

18 hours agoAll Connecticut residents who claimed a dependent child aged 18 or younger on their 2021 tax return may be eligible. Use our child tax credit calculator to determine your eligibility for tax year 2020 or tax year 2021. Your amount changes based on the age of your children.

These additional credits include. Along with 1400 stimulus checks and enhanced unemployment benefits the package includes updates to the current child tax credit. The Child Tax Credit.

The only caveat to this is if you and your childs other parent dont live. If taxpayers received more advanced. Youll claim the other half of the credit when you file your 2021 taxes due April 18 2022.

Families earning less than 150000 per year jointly. Advance Child Tax Credit Eligibility Assistant - IRS tax forms. If you had dependents who were 18 years old or full-time college students through age 24 the IRS should have sent you a one-time payment of 500.

The IRS will pay 3600 per child to parents of children up to age five. The CTC income limits are the same as last year but there is no longer a minimum income so anyone whos otherwise eligible can claim the child tax. File a federal return to claim your child tax credit.

Check your eligibility a. You must have claimed the Child Tax Credit on your most recent tax return or gave us information about your qualifying children in the Non-Filers. All children must possess a Social Security Number.

The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. The remaining half of the credit for eligible may be claimed when the advanced payments are reconciled with the total eligible Child Tax Credit on the 2021 income tax return. The phase-out threshold was increased from 75000 to 200000 for single filers and from 110000 to 400000 for those filing jointly.

Length of residency and 7. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The maximum total amount of CTC for 2021 is 3000 per child under 18 years old and 3600 per child under 6 years old.

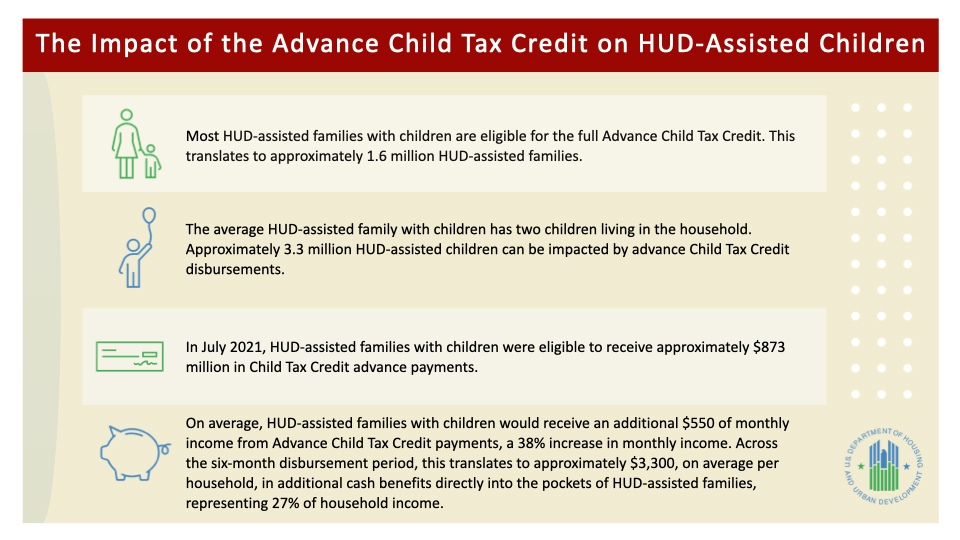

The Child Tax Credit is intended to offset the many expenses of raising children. Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December. In 2021 then you will receive the child tax credit so long as your income is below 440000 if youre married and filing jointly.

How much is the child tax credit worth. The monthly advance Child Tax Credit payments were as much as 300 for each child under six and 250 for each child six and older. You can file a 2021 tax return and potentially receive thousands of additional dollars in tax credits when you file.

If you havent filed a tax return before or dont file every year and are eligible for the Child and Dependent Care Credit be sure to file to receive the credit this year. Up to 1800 for each child up to age 5 and up to 1500 for each child age 6-17. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. The credits scope has been expanded. If your tax is 0 and your total earned income is at.

In the tax year 2021 under the new provisions families are set. As a result you were eligible to receive advance Child Tax Credit payments for your qualifying child. Making a new claim for Child Tax Credit.

This amount begins to decrease when an individual has income higher than 75000 112500 for Head of Household and 150000 for married couples. Families eligible for the Child Tax Credit are those that have children who will not turn 18 before January 1 2022 and that do not provide more than 50 of his or her own support. You andor your child must pass all seven to claim this tax credit.

It doesnt matter if they were born on January 1 at 1201 am. The amount you can get depends on how many children youve got and whether youre. In previous years 17-year-olds werent covered by the CTC.

Or December 31 at 1159 pm if your child was born in the US. Enter Payment Info Here tool in 2020 to qualify for advance payments of the Child Tax CreditTo file a tax return and become eligible see Non-filer Sign. There is an income.

Simple or complex always free. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17.

Here S Who Qualifies For The New 3 000 Child Tax Credit

What To Know About The New Monthly Child Tax Credit Payments

Child Tax Credit What We Do Community Advocates

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Did Your Advance Child Tax Credit Payment End Or Change Tas

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Child Tax Credit 2021 8 Things You Need To Know District Capital

2021 Child Tax Credit Advanced Payment Option Tas

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit What We Do Community Advocates

Child Tax Credit 2021 8 Things You Need To Know District Capital

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

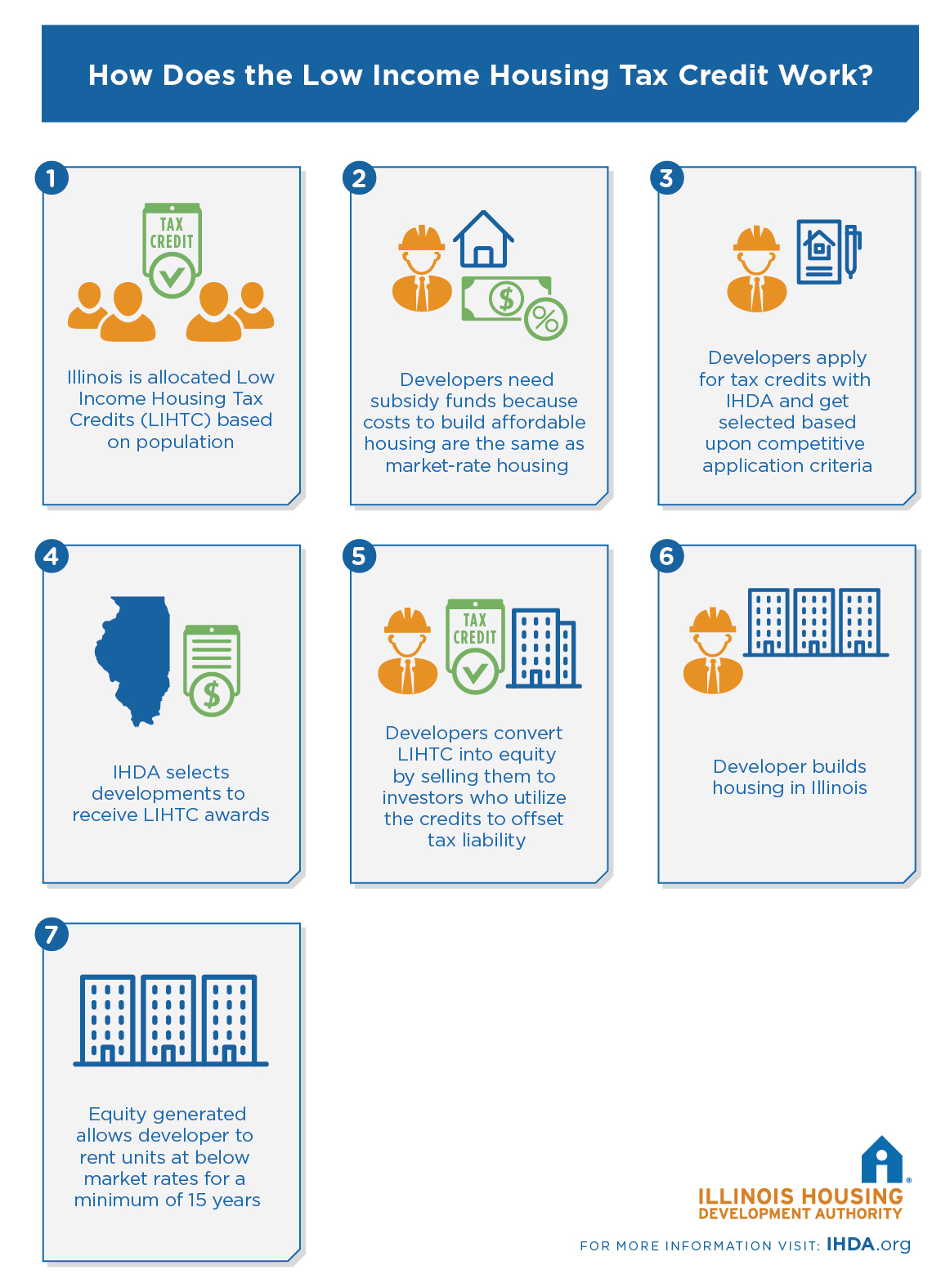

Low Income Housing Tax Credit Ihda

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities